Land depreciation calculator

Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase. A land loan calculator that allows one to enter data for a new or existing land loan to determine ones payment.

Depreciation And Off The Plan Properties Bmt Insider

Toyota as a brand does very well in maintaining its value consistently ranking at the top of popular brands.

. Land Rover Discovery Repair Costs. If you want a vehicle line that will hold its value over the long run Toyota is and has been the one to beat. The Volumetric Weight of an item is used in order to measure how much space that the items they are transporting is going to take up in the transportation vehicle.

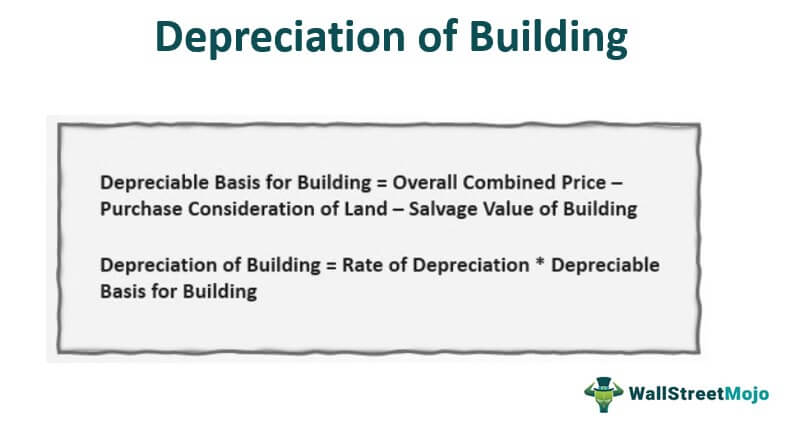

Land improvements are any enhancement to land that increases its value. The land is a non-depreciable fixed asset for companies due to its infinite useful life. A P 1 - R100 n.

Use our calculator to find out custom depreciation rates for a specific model based on factors like year and mileage driven. Estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset. Machinery equipment currency are.

The average car depreciation rate is 14. No matter what size project you are endeavoring to begin or finish if you decided on a whim to throw up a concrete slab before properly planning ahead we have the calculators you need to complete the task at hand. You must deduct the value of the land.

Use our depreciation recapture tax calculator to determine the amount youll be taxed on the sale of your rental property and find out how to avoid depreciation recapture using a 1031 exchange. Vacant Land Loan Calculator to calculate monthly mortgage payments with a land contract amortization schedule. Land Rover Discovery Sport Maintenance Schedule.

Because land isnt depreciable you can only include the cost of the house when figuring the basis for depreciation. The salvage value is estimated at INR 25000. Land Rover Discovery Maintenance Schedule.

Customs value is then calculated by applying the depreciation to the CRSP value. Free MACRS depreciation calculator with schedules. Request a tax depreciation schedule quote BMT has completed more than 800000 property depreciation schedules helping Australian taxpayers just like you save thousands of dollars every year.

Refinancing Guide Dash Cam Guide. However land improvements with useful life are depreciable. It will calculate straight line or declining method depreciation.

Toyota does so impressively with three models 4Runner Tacoma and Highlander ranking in the Top 10 after 5 years. On the date of the change in use your property had a fair market value of 168000 of which 21000 was for the land and 147000 was for the house. Legal and recording fees.

D P - A. Here is the calculation for three years. 19952001 Acura Integra GS-R.

How Do I Know What Depreciation Rate To Use With The Decliing Balance Method. Live Chat w Mechanic. Toyotas are a safe bet new or.

The calculator computes both for 2022 and 2021. The Car Depreciation Calculator uses the following formulae. Adheres to IRS Pub.

Double declining depreciation 2 x straight-line depreciation rate x value at the start of the year Example. A decrease in an assets value may be caused by a number of other factors as well such as unfavorable market conditions etc. KRA provide the current Retail Selling Price CRSP for your vehicle.

The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage. Important land area or historic building. The other overhead cost table facilitates calculation of fixed costs for other capital assets namely breeding livestock and land.

Call our expert team today on 1300 728 726 or complete the form below to find out how we can help you maximise the deductions from your investment property. The formula for this type of depreciation is as follows. Supports Qualified property vehicle maximums 100 bonus safe harbor rules.

The deed of conservation easement describes the conservation purpose the restrictions and the permissible uses of the property. The monetary value of an asset decreases over time due to use wear and tear or obsolescence. 2022 real estate capital gains calculator gives you a fast estimate of the capital gains tax.

But you also add to the basis your settlement costs. Conservation easements permanently restrict how land or buildings are used. The excise duty import duty VAT and the IDF Fee are all calculated from the customs value.

This will be the only land contract calculator that you will ever need whether you want to calculate payments for. The smart depreciation calculator that helps to calculate depreciation of an asset over a specified number of years also estimate car property depreciation. One can argue that the useful life of land is perpetual.

Depreciation costs for purchased mature cows are calculated using the difference between purchase price and salvage value divided by years of useful life. Look at our specification and depreciation data before you buy or sell. One can enter an extra payment and a rate of depreciation as well to see how a lands value may decrease.

This calculation is as follows. Depreciation recapture is the USA Internal Revenue Service procedure for collecting income tax on a gain realized by a taxpayer when the taxpayer disposes of an asset that had previously provided an offset to ordinary income for the taxpayer through depreciationIn other words because the IRS allows a taxpayer to deduct the depreciation of an asset from the taxpayers. This is useful as the Freight Forwarding industry as this industry involves moving a variety of large goods using Air transport Sea transport or Land transport.

19911995 Toyota MR2 Turbo. Customs Value is the CRSP value with depreciation applied. 19931997 Toyota Land Cruiser.

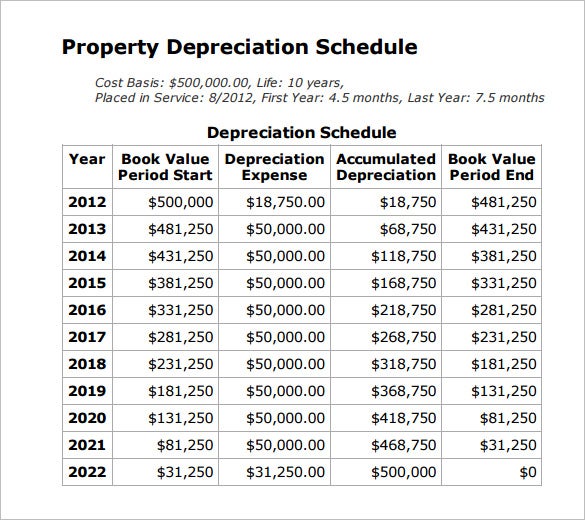

Its building value because land cant be depreciated The investor takes 30000 depreciation each year for ten years. The math is a bit more complex than well want to dive into here but to get a ballpark of your expenses you can enter the cost of your property and other variables into a property depreciation. This depreciation calculator is for those that need to calculate a depreciation schedule for a depreciating asset such as an investment property.

The calculator based on your input calculates. This decrease is measured as depreciation. 200152002 BMW M Roadster.

The deed must be recorded in the public record and must contain legally. Our free construction calculators can help you complete small landscaping jobs total home makeovers or DIY projects around the house. The above journal entry is similar to a depreciation recording entry for any other fixed asset.

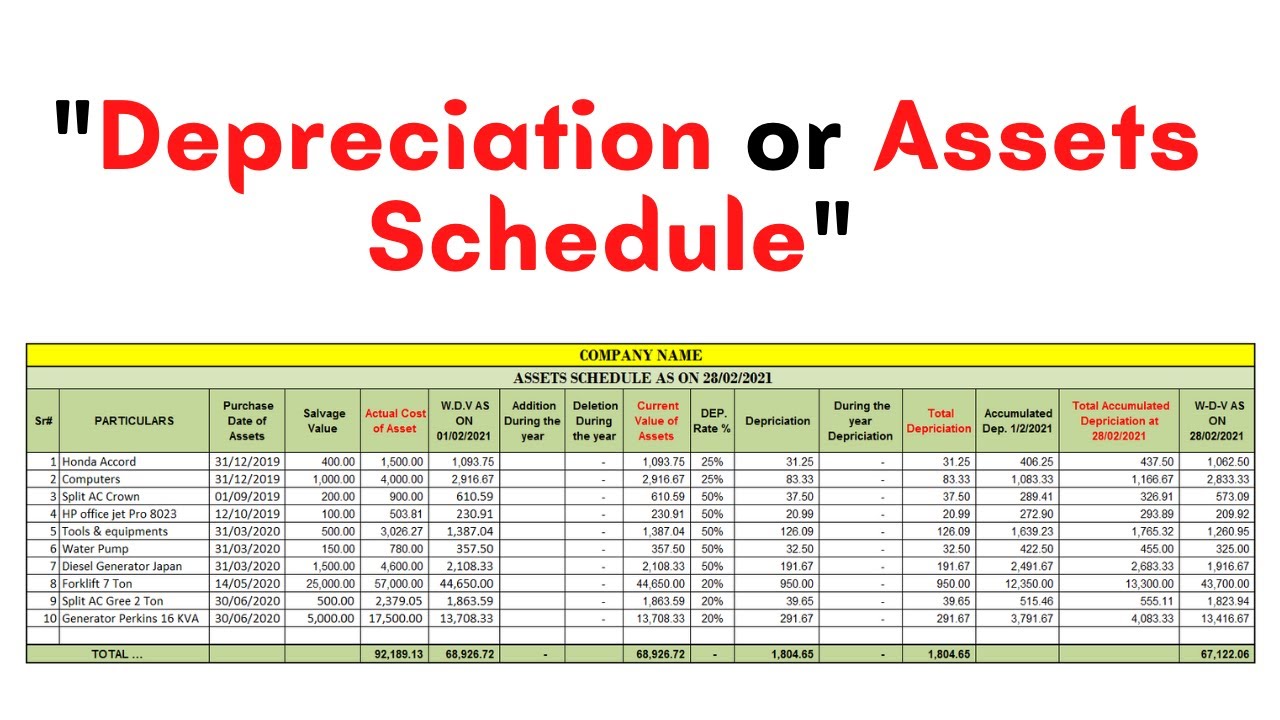

A company acquires a machine for INR 250000 with an expected useful life of 10 years.

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation Formula Calculate Depreciation Expense

Macrs Depreciation Calculator With Formula Nerd Counter

Macrs Depreciation Calculator Straight Line Double Declining

How To Use Rental Property Depreciation To Your Advantage

How Is Property Depreciation Calculated Rent Blog

Depreciation Formula Calculate Depreciation Expense

Free Construction Cost Calculator Duo Tax Quantity Surveyors

How Depreciation Claiming Boosts Property Cash Flow

A Guide To Property Depreciation And How Much You Can Save

Depreciation Of Building Definition Examples How To Calculate

How To Prepare Depreciation Schedule In Excel Youtube

Rental Property Depreciation Rules Schedule Recapture

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Free Macrs Depreciation Calculator For Excel

Depreciation Schedule Template For Straight Line And Declining Balance

Section 179 For Small Businesses 2021 Shared Economy Tax